Our Blog

Read the recent blog posts about Prismcube Consultancy Services

SET-OFF AND CARRY FORWARD OF LOSSES

04-11-2021

In every form of business, there can be profit and losses, with losses being particularly difficult to swallow. Though the Indian Income Tax Act allows for the benefits of losses as well. The statute includes provisions for loss set-off and carry-forward.

Notices, Appeal, Revisions, Search & Seizure under Income Tax

01-11-2021

If someone receives a notice, they must act on it. The Central Board of Direct Tax, also known as CBDT, has launched a system called the Centralized Communication Scheme, which states that all communication must be done electronically.

Incorporation of Private Limited Company – FAQ’s

26-10-2021

Friends, beginning a new firm as a lone entrepreneur is not a good idea in today's competitive business environment. Because the liability of a proprietorship firm owner is infinite, they also have difficulty acquiring finances and obtaining better human resources.

In this blog, we'll go through some frequently asked questions regarding forming a private limited company, which are frequently asked by new business owners.

Benefits of Filing Income Tax Return on time

22-10-2021

Even if you don't come under any necessary provisions, there are numerous advantages to completing a tax return.

1. Simple loan processing

2. VISA Application

3. Serves as Proof of Income

4. Earn a tax refund

5. Losses carried forward

6. Avoid Penalty

Section-8 Company-Incorporations and Myths

20-10-2021

Section 8 corporations are those formed with the goal of promoting the arts, business, education, charity, environmental protection, sports, welfare, medicines, and so on. The company's profits, as well as money earned through events and donations, cannot be used to distribute dividends to its members. The funds raised should be used for charity and promotional purposes.

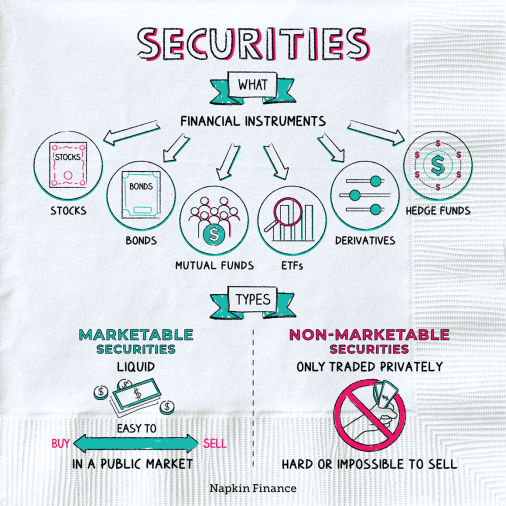

Right Issue of shares

18-10-2021

Section 62(1)(a) of the Companies Act, 2013 governs the idea of a right issuance of shares. The provision in this section relates to the Company's expansion in subscribed share capital through the issuance of additional shares.

Simply put, a right issue of shares is an offer of shares to all existing Equity or Preference shareholders in proportion to their current shareholding in the company. It should be noted that this mechanism can be used to issue both equity and preference shares, as both will result in an increase in the Company's subscribed share capital.

OTHER SOURCES OF INCOME

15-10-2021

Income that does not fit into any of the other categories will be classified as 'Income from Other Sources.'

In this article, we look into the categories of other sources of income deeply.

Appointment of First Auditor under Companies Act, 2013 in Non-Government Companies

14-10-2021

"Every company shall, at its first annual general meeting, appoint an individual or a firm as an auditor who shall hold office from the conclusion of that meeting until the conclusion of its sixth annual general meeting and thereafter until the conclusion of every sixth meeting, and the manner and procedure of selection of auditors by the members of the company at such meeting shall be such as may be prescribed," according to Section 139 of the Companies Act, 2013 (Act).

Section 194N: TDS on Heavy Cash Withdrawal from Banks/ Post Offices

11-10-2021

With the change to the Finance Act of 2020, section 194N was replaced with 83A, which applies a 2% TDS on withdrawals of more than Rs. 1 crore. This clause went into effect on July 1, 2020.

Every person including –

(i) Individuals

(ii) HUF

(iii) Company

(iv) Partnership firms or LLP

(v) Local authorities

(vi) Any association of person (AOPS) or Body of Individuals (BOI)

(vii) Any other assesses

Why should you double-check Form 26AS before filing your tax return?

08-10-2021

Form 26AS is an annual tax statement that provides data of tax paid, tax deducted, or tax collected at source, as the case may be, of the respected assessee. It is critical to thoroughly verify Form 26AS before filing Income Tax Return. The assessee is required to report the relevant income in his ITR, which is reflected in Form 26AS, against which TDS/TCS has been deducted.

Implications of the Goods and Services Tax (GST) on Imports

07-10-2021

Imports and exports are critical in not only determining but also deciding the country's economic health. Though imports are discouraged, no country can meet its economic and consumption demands without them. India's imports were estimated to be worth $390 billion in 2020-21. In this post, we'll focus on the records that must be kept and the proper use of GST tax credits.

Applicability of Change in GST Rates of Various Services

06-10-2021

Section 14 of the CGST Act, 2017, which is reprinted as follows, governs the applicability of tax rates in the event of a change in tax rate in respect of a supply of goods or services.

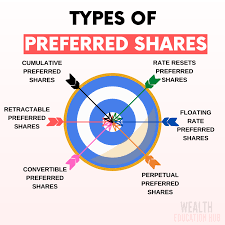

Preferential Allotment of Shares – Key Factors, Procedure & Timeline

05-10-2021

A firm can raise capital in a variety of ways, including the issuance of equities, preference shares, debentures, bonds, and deposits. If the shareholders do not want to dilute their position, they can issue debentures, bonds, or accept deposits, among other options. Another alternative is for the corporation to issue shares (equity or preference), with the option of initially issuing shares to existing shareholders and then to others.

Disqualified from directorship by ROC under Section 164(2)(A)

02-10-2021

When a person is disqualified under section 164(2)(a)?

Any person who has failed to file financial statements (e-Form AOC-4) or annual returns (e-Form MGT-7) for three consecutive financial years will be ineligible to be appointed as a Director of that company or any other company for the next five years.

Turnover Certificate for various purposes

01-10-2021

A turnover certificate is a detailed factual statement that attests to an entity's turnover in accordance with the requirements. This certificate guarantees the users that the business entity made a certain amount of revenue during a certain period of time.

Section 80CCC deduction – Contribution to certain Pension Funds

29-09-2021

If the assessee has paid any amount towards any annuity plan of the Life Insurance Corporation of India (LIC) or any other insurer for the purpose of receiving pension from a pension fund, a deduction is allowed. The pension paid from the policy is also included in taxable income. This section restricts the use of a general life insurance policy to claim deductions. However, premiums paid under Section 80C can still be deducted from taxable income.

About Debentures under Companies Act, 2013

28-09-2021

Sometimes when the Company needs funds without diluting its equity state, the Company opts for Debentures Issue. Debenture is debt to the Company. It’s like a loan which needs to be repaid over a certain period of time. Debentures carry fixed interest rate. Let’s discuss more on debentures. Both corporations and governments frequently issue debentures to raise capital or funds.

Appointment of Auditor in Casual Vacancy in an OPC

25-09-2021

As it enjoys advantages over other types of corporations, such as the lack of a necessity to hold a general meeting, the lack of a requirement to hold a board meeting (if there is only one director), the lack of a requirement to prepare cash flow statements, and so on.

Link UAN with AADHAAR

24-09-2021

During this pandemic, the Employees' Provident Fund Organization (EPFO) of India's Ministry of Labour & Employment has given instructions for transferring EPF online (COVID-19)

If you do not link your EPF account to Aadhaar by December 31, 2021, the company's contribution may be halted.

AGM Due date Extension for FY 2020-21

23-09-2021

DGCoA-MCA Office Memorandum No. CL-II-03/252/2021-0/o Dated September 23, 2021 The MCA has extended the deadline for companies to convene their Annual General Meetings (AGMs) for the financial year 2020-21, which ended on March 31, 2021, by two months. Following the extension of the due date, various questions have arisen in the minds of stakeholders.

Annual Filing One Person Company

22-09-2021

One Person Company is a company that has only one person as its member. Being just one-member company, the OPC has lesser compliance requirement compared to Private Limited Company or Limited Liability Partnership.

Food licences and registration with the Food Safety and Standards Authority of India (FSSAI)

21-09-2021

Any person who manufactures or sells food, or a petty retailer, hawker, itinerant vendor, or a temporary stall holder, or a small scale or cottage or other enterprises linked to food, or a tiny food business operator with an annual turnover of up to Rs. 12 Lacs.

GST Audit – Planning & Strategy to steer clear of audit

18-09-2021

Audit, Investigation and Scrutiny as such sends shivers down the spine irrespective of well preparedness on the part of the assesses. This one aspect remains the same be it erstwhile IDT system – Excise, Service Tax, VAT, Customs, etc. or GST.

Rule :9A Extension of reservation of Name in certain cases

17-09-2021

On December 24, 2020, the Ministry of Corporate Affairs published the Companies (Incorporation) Third Amendment Rules, 2020, which included Rule 9A "Extension of Reservation of Name in Certain Cases." This Rule extends the time limit for reserving a name that has been approved by the Central Registration Centre (CRC).

Woman Director

16-09-2021

[2nd Proviso to Section 149(1) of Companies Act, 2013 read with Rule 3 of The Companies (Appointment and Qualifications of Directors) Rules, 2014]

Fast-Track Insolvency Resolution Procedure: An Ease to Small Creditors

15-09-2021

Time is a valuable resource that one should keep track of. When dealing with a situation involving financial debts and losses, it is important to keep this in mind. Previously, insolvency or liquidation procedures were lengthy and time-consuming; however, the Insolvency and Bankruptcy Code of 2016 made the process of insolvency or liquidation considerably simpler.

Exemption available for educational institution sec 10 (23C) & 11

14-09-2021

This article discusses exemptions available for an Educational Institution u/s 10(23C) of the Income Tax Act and comparison of the same to the provisions of Sec 11 of Income Tax Act.

TDS/TCS Capital Gain Tax exemption on transfer of capital assets / goods from Air India

13-09-2021

Air India Assets Holding Limited receives capital assets from Air India Limited.

The following Income Tax Notifications under the Income Tax Act, 1961, the CBDT has provided for Transactions that should be regarded as transfers with respect to the transfer of capital assets from Air India Limited to Air India Assets Holding Limited and to notify exemption from TDS and TCS on certain transactions.

Tax Planning, Tax avoidance and Tax evasion

11-09-2021

Tax is a mandatory fee placed by the government on an individual or company in order for the government to collect revenue for public works, and we are all aware of the necessity of tax for any country's development.

Requirement of CSR-1 Form by NGOs/Societies/Trust to avail Corporate Funding

10-09-2021

In this article, we shall be discussing that what is the CSR-1 Form and what documents are required to be attached along with these forms and what are the pre-requirements for the NGOs/ Trusts and Section 8 companies for filing of the CSR-1 Form

Related Party Transactions sec 188

09-09-2021

According to Section 2(76) of The Companies Act, 2013, related party”, with reference to the company means:

(i) a director or his relatives

(ii) Key Managerial personnel or his relative

(iii) a firm, in which a director, manager or his relative is a partner

(iv) a private company in which a director or manager or his relative is a member or director

Shares with Differential Voting rights

08-09-2021

The contribution of the Company's Owners is the share capital. According to the Companies Act of 2013, there are two types of share capitals.

1. Equity

2. Preference

Again, equity shares/capital can be subdivided into the following categories: –

1. Equity shares with voting rights

2. Equity shares without voting rights.

Report on AGM

07-09-2021

Every Listed Public Company must prepare an Annual General Meeting report that includes confirmation that the meeting was convened, held, and conducted in accordance with the provisions of this Act and the rules made thereunder.The company shall file with Registrar a copy of Report in Form MGT 15 within 30 days of AGM.

Understanding Mismatch Concept under GST

06-09-2021

In the context of GST, mismatch refers to the level of discrepancy between the information provided in GSTR – 3B and the information provided in GSTR – 2B and GSTR – 2A. GSTR – 3B is a consolidated form of monthly returns that comprises information on a registered person's total inward supply, outbound supply, input tax availed, tax paid, and tax collected over the course of a year.

Taxability of interest on PF contributions above Rs. 2.5 lac

03-09-2021

From FY 2016-17, a programme for presumptive taxation was implemented under section 44ADA.

For small professions, Section 44ADA provides a simplified form of taxation. Profits and income deriving from professions listed under Section 44AA(1) of the Income Tax Act of 1961 are subject to presumptive taxation under Section 44ADA.

Section 44ADA – Presumptive Tax Scheme for professionals

02-09-2021

From FY 2016-17, a programme for presumptive taxation was implemented under section 44ADA.

For small professions, Section 44ADA provides a simplified form of taxation. Profits and income deriving from professions listed under Section 44AA(1) of the Income Tax Act of 1961 are subject to presumptive taxation under Section 44ADA.

Corporate Social Responsibility- Applicability, CSR committee & Activities

02-09-2021

Here we can look deep into the Corporate Social Responsibilities including CSR Committee and its Activities.

Is it necessary to have "Zero Outstanding" of audit fees before signing the audit report?

01-09-2021

The auditor is now required to ensure zero outstanding of audit fee before signing current year audit report as per the Revised Code of Ethics.

Legal Position as per Code of Ethics, 2019

Rationalisation of provisions relating to tax audit in certain cases

31-08-2021

Under section 44AB of the Act, every person carrying on business is required to get his accounts audited, if his total sales, turnover or gross receipts, in business exceed or exceeds one crore rupees in any previous year. In case of a person carrying on profession he is required to get his accounts audited, if his gross receipt in profession exceeds, fifty lakh rupees in any previous year. In order to reduce compliance burden on small and medium enterprises, through Finance Act 2020,

Section 194K—Tax Deduction on Income from Mutual Fund Units

30-08-2021

During Budget 2020, Nirmala Sitharaman recommended adding Section 194K to the Finance Act. This clause allows any resident individual to deduct the amount paid on mutual fund units, up to a certain limit. Let's have a look at Section 194K in terms of:

Mandatory filing of MGT-14 for Board Resolution in case of Private Placement despite of Exemption to Private Companies.

23-08-2021

As per Rule 14(8) of Companies (Prospectus of Securities) Rules, 2014, “a company shall issue private placement offer cum application letter only after the relevant special resolution or Board Resolution has been filed in the Registry.

Understanding the concept of Transmission of Securities

19-08-2021

‘Transmission of Securities’ means transferring the ownership of securities to legal heirs or successor or nominee or surviving joint holder, by operation of law, in case of death of a security holder, insolvency, inheritance or lunacy of the member.

How to take loan, before filing of Form INC 20A

14-08-2021

Companies (Amendment) Ordinance, 2018 dated 02.11.2018 introduced New Section 10A after Section 10 in MCA, and same has been inserted in Companies (Amendment) Act, 2019.

Section 10A mandates the filing of a "statement of commencement of business" within 180 days of the company's incorporation. If a company fails to file, it will face a slew of penalties and restrictions on company.

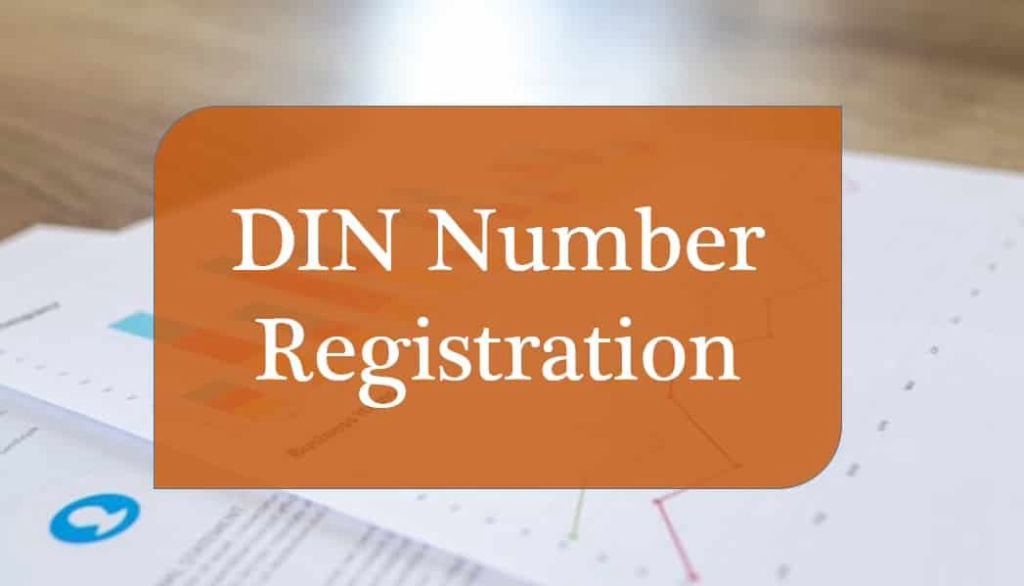

How to Apply Din before Incorporation of Company

13-08-2021

It is an 8-digit unique identification number that has lifetime validity. Through DIN, details of the directors are maintained in a database. DIN is specific to a person, which means even if he is a director in two or more companies, he has to obtain only one DIN.

Government identified 2,38,223 companies as shell companies between 2018-2021

12-08-2021

The phrase "Shell Company" is not defined under the Companies Act, but it usually refers to a company that has no active commercial operations or major assets and is used for illegal purposes such as tax evasion, money laundering, obscuring ownership, benami properties, and so on.

Tax refund concerning applicability of provisions of section 234D

11-08-2021

Initially, based on the processing of the income tax return, a refund may be granted to the taxpayer under intimation as per section 143(1),

Subsequently, the taxpayer can be subjected to scrutiny,

During the regular assessment, it may happen that the refund amount so granted under section 143(1) is either reduced or is totally nullified,

Accordingly, the refund so received by the taxpayer under section 143(1) needs to be paid back to the department.

Rates of depreciation as per Income Tax Act

10-08-2021

The depreciation allowance under Section 32(1)(ii) of the Act in respect of any block of assets entitled to more than 40% shall be restricted to 40% on the written down value of such block of assets with effect from 1 April in the case of a domestic company that has exercised an option under Section 115BA of the Income-tax Act, 1961 to reduce the tax rate from 30% to 25%.

Mutual Fund Investments for Non-Individuals

09-08-2021

The taxes structure for corporations, proprietorships, and other non-individuals differs slightly. After all, only individuals and HUFs are eligible for deductions under Section 80C of the Income Tax Act.

So, what can businesses do?

You can reduce your tax liability by taking advantage of the options afforded by India's current tax regime for non-individuals.

Tax Implications of Crypto currencies

07-08-2021

People are discovering fantastic chances with excellent returns on their investment (ROI). Despite the massive increase in the number of crypto currency traders and investors, individuals in India are concerned about taxation and the asset's future. Due to circumstances such as the reach as high and fall of prices, the views of certain high-net-worth individuals and actions taken by various governments, cryptocurrencies have recently been in the spotlight.

Retrospective Tax on capital Gain

06-08-2021

Our country's economy is at a situation when rapid recovery is required, and foreign investment can play a critical role in this. For speedier economic growth and employment, foreign investment is required. We are all aware of how China has expanded in recent years as a result of foreign investment.

TDS on purchase of goods under Section 194Q

05-08-2021

People are discovering fantastic chances with excellent returns on their investment (ROI). Despite the massive increase in the number of crypto currency traders and investors, individuals in India are concerned about taxation and the asset's future. Due to circumstances such as the reach as high and fall of prices, the views of certain high-net-worth individuals and actions taken by various governments, cryptocurrencies have recently been in the spotlight.

Deduction u/s 80JJA (Income Tax) – Additional Employee Cost

04-08-2021

The deduction available under Section 80JJAA of the Income Tax Act, 1961 (‘Act’) incentivize the organizations for generating employment and allows an additional 30% deduction of the additional employee cost for 3 assessment years (‘AYs’) beginning with the AY in which additional employee cost is incurred.

Statutory and Tax Compliance Calendar for August 2021

03-08-2021

GST (GSTR 1, GSTR 3B, GSTR 6, GSTR 5 & GSTR 5A), Income Tax (Due date of TDS Payment, Advance Tax Payment, TDS Return Filing, Income Tax Return Filing, TDS Certificate Issue, etc.), EPF, ESIC, LODR/SEBI, Companies Act, 2013 and other compliances are included in the Statutory and Tax Compliance Calendar. It explains the form that must be filled out and the deadline for doing so.

Marriage Gifts and Taxation

02-08-2021

Gifts received by a newly-wed couple as wedding presents are tax-exempt. Regardless of the value of the gift, if they are received by a newly-wed couple from immediate family, such as their parents, siblings or any of their siblings’ spouses, or the siblings of their parents, they are exempt.

Operation Clean Money: An Overview

30-07-2021

The ITD's vision is to "partner in the nation-building process through progressive tax policy, efficient and effective administration, and enhanced voluntary compliance," according to the Vision 2020 document.

IRS launches 'Tax Pro Account' feature

29-07-2021

On Monday, the IRS announced the "Tax Pro Account," an online tool that automates the submission of powers of attorney (POAs) that empower tax practitioners to represent individual taxpayers and tax information authorizations (TIAs) that allow them to examine those taxpayers' accounts. However, the IRS has grander intentions for the Tax Pro Account interface in the long run.

What is an Indian Seafarer's Non Resident External Account?

28-07-2021

Non Resident External (NRE) account is an INR denominated account. Foreign currency earnings can be deposited in NRE accounts which are maintained in Indian Rupees.

Major Changes in the Mechanism of Income Tax wef 1 April 2021

27-07-2021

The notable changes to the income-tax regime that will take effect on April 1, 2021:

No requirement of tax filing for senior citizens above 75, Pre-filled IT forms, Tax on interest on PF, Income tax return (ITR) non-filers, Penalty imposition for non-linking of Aadhar & PAN, and High TDS/TCS Rate for submission of bills under LTC Cash Voucher Scheme.

12 Major Income Tax Amendments for FY 20-21 (AY 2021-22)

26-07-2021

Many amendments has been made by Income Tax and Govt in last financial year I.e. 2020-21. However, out of those amendments many amendments are effective from 01st April 2021.

Issues of Re-Assessment Proceedings u/s 148 of Income Tax Act

23-07-2021

In exercise of the powers conferred by section 3(1) of the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 (TLA Act, 2020), the CBDT issued notification No. 20/2021, dated 31-03-2021, extending the deadline for issuance of notice u/s 148 until 30.06.2021.

10 Company Law Amendments effective from 01st April 2021

22-07-2021

Many amendments has been made by MCA and Govt in last financial year I.e. 2020-21. However, out of those amendments many amendments are effective from 01st April 2021.

Registration of new companies sees surge during the pandemic

19-07-2021

The two waves of Covid-19 pandemic and the consequent business and economic uncertainty did little to dent the entrepreneurial spirit of Indian businessmen.This is evident in the month-on-month new company registrations consistently going up after hitting a nadir in April 2020.

New Income Tax e-Filing Portal: A leading or a limping solution

19-07-2021

The Indian government has been extolled for the many new initiatives on the digital front that has been introduced encompassing various aspects of the economy. Digitalisation has taken the world by storm and India has also been in the forefront of introducing new digital measures across the economy. This year’s Budget was also a digital budget.